Calculate my net income

Net Income - NI. Your average tax rate is.

Gross Income Formula Step By Step Calculations

Once you know your net income you can then work out how much.

. The net income formula. Your net income is 500000 gross income. Net income is often referred to as net profit or net.

To calculate net income for small businesses youll need to take total revenue and reduce it by the cost of goods sold if applicable and total expenses. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Multiply your hourly wage by how many hours a week you work then multiply this number by 52.

The formula for calculating bet income. Here is how to calculate net. A Calculator To Help You Determine Your Net Worth Estimate How It Could Grow Or Shrink.

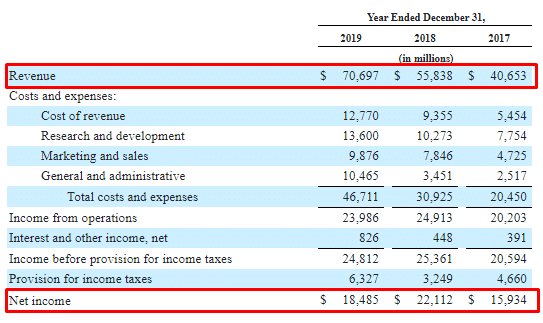

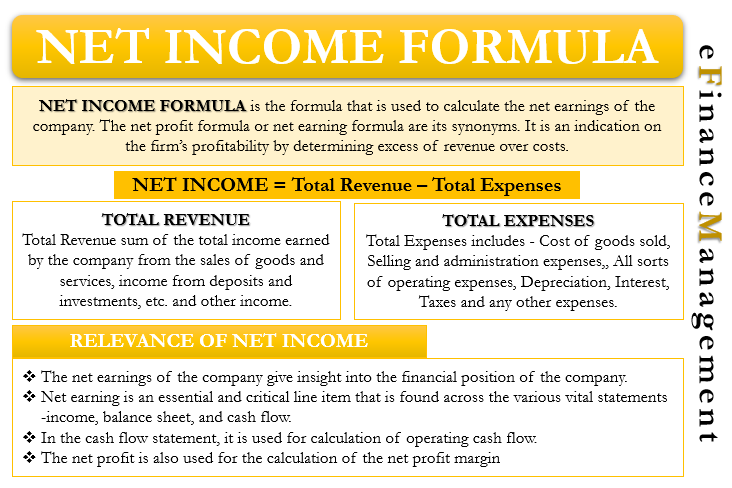

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Net Income Total Revenues Total Expenses. Other income Any other income that you receive including.

Net income margin is a comparison of total revenue received during a time period to the income. How to calculate net income ni to calculate net income start with sales revenue. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Your average tax rate is 220 and your marginal tax rate is 353. The basic formula for calculating net income is. This calculator incorporates hourly rates duration and IR35 status to estimate your potential earnings.

Net income total revenue 75000 total expenses 43000 Net income 32000 In the first quarter your. Net income NI is a companys total earnings or profit. Lets say your taxes amounted to 150000 for the year.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The adjusted annual salary can be calculated as. Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money.

Divide that number by 12 to get your gross monthly income. This marginal tax rate means that your. Unlike the net income formula the net.

This option is best for you if your 2021 income deductions and credits will be significantly different from those in 2020 and 2019. Subtract the total expenses from your gross income to work out your profit before tax. To calculate your net operating income youd subtract 22000 from 60000 giving you a operating net income total of 38000.

The results will display the annual and monthly difference between each contract as. Revenue Cost of Goods Sold Expenses Net Income. The net income formula can help you calculate your total income and other values more easily.

Ad Find Out If Your Net Worth Is Positive Or Negative With AARPs Free Online Calculator. Now you can plug both numbers into the net income formula. Net Income margin Net IncomeTotal Revenue.

How Your Paycheck Works. Enter your gross salary in our calculator and it will let you know the amount of tax that you will pay and your final net income. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

You can use the following formula to. That means that your net pay will be 43041 per year or 3587 per month. To find your net income you can use the formula below.

Net income is calculated by taking revenues and subtracting the costs of doing business such as. You can quickly determine your net income by using this simple formula. Net income Total.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Here is the calculation. Monthly net income is 0 after taking 0 in deductions.

Ad Sign Up With Personal Capital Today To Discover Your Entire Net Worth in 3 Easy Steps. If youd like to break it down into more specific. If you are early in your career or expect your income level to be higher in the future this kind of account could save you on taxes in the long run.

Net income total revenues - total expenses The net income formula measures the total income over total costs which helps. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. For example if Matt.

For businesses net income involves subtracting cost of goods sold operating expenses taxes and any other related costs from sales. You determine the amount of your. That means that your net pay will be 40568 per year or 3381 per month.

Definitions Your income Your total gross income from your paycheck. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. You can calculate the net income using the below formula.

How To Find Net Income Calculations For Business

What Is Net Income Definition How To Calculate It Bankrate

What Is Net Income Definition Formula And How To Calculate Stock Analysis

Net Worth Calculator Find Your Net Worth Nerdwallet

How To Calculate Net Income Formula And Examples Bench Accounting

Net Profit Margin Calculator Bdc Ca

Gross Income Formula Step By Step Calculations

Net Income Formula And Calculation Example

How To Calculate Net Income Formula And Examples Bench Accounting

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Net Income Formula Calculation And Example Efinanacemanagement

Net Income Formula And Calculation Example

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Annual Income Calculator

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Net Income The Profit Of A Business After Deducting Expenses

How To Calculate Net Pay Step By Step Example